Overview Of Key Bank And Key Credit Cards :

Being established in the year 1825, Key Bank is a famous primary subsidiary banking and finance organisation of Key Corp. which is also an ancient institute of America. Lots of people and organizations are getting benefited from Key Bank every day through their financial solutions. Key Bank is especially famous for their different credit card lines suitable for all kind of credit needs of their members. The Credit Card solutions provided by Key Bank are suitable for personal use as well as for business purposes.

In this article, we will describe about Key Credit Cards which is a very special and popular credit line option offered by Key Bank. Here, in this article, you will get, step by step information, like benefits, sign in and sign up guidelines, username and password recovery procedures, rates and interest etc. about Key Credit Cards. Please go through the entire article to learn everything about Key Credit Cards.

Key Credit Card Rates & Interest :

There are four types of Key Credit Card options are available –

Key Cash Back Credit Card –

- A special 0 % introductory Balance Transfer APR facility is available with this Key Cash Back Credit Card for the first 12 billing cycles made during first 60 days of account opening. After that, you will be charged variable APR on Balance Transfers and that amount will be from 13.99 % to 22.99 % depending on the credit worthiness.

- No annual fee is included with Key Cash Back Credit Card.

- You can earn up to 2 % Cash Back on using your Key Cash Back Credit Card for daily transactions.

Key Bank Latitude Credit Card –

- A special 0 % introductory Balance Transfer & Purchase APR facility is available with this Key Cash Back Credit Card for the first 15 billing cycles made during first 60 days of account opening. After that, you will be charged variable APR on Balance Transfers and that amount will be from 9.99 % to 19.99 % depending on the credit worthiness.

- No annual fee is included with Key Cash Back Credit Card.

- You can earn up to 2 % Cash Back on using your Key Cash Back Credit Card for daily transactions.

Key Secured Credit Card –

- This special type of credit card will help you to improve your credit score.

- Annual Percentage Rate on purchases for Key Secured Credit Card is 22.99 % and this rate is variable as per market and your credit worthiness.

- No annual fee is included with Key Secured Credit Card.

- Late payment fee of this card is up to $ 39.

Key2More Rewards Credit Card –

- A special 0 % introductory Balance Transfer & Purchase APR facility is available with this Key Cash Back Credit Card for the first 6 billing cycles made during first 60 days of account opening. After that, you will be charged variable APR on Balance Transfers and that amount will be from 12.99 % to 21.99 % depending on the credit worthiness.

Key Credit Card Benefits :

- You will get special facilities like unlimited 2 % Cash Back which will help you to save more.

- You can easily redeem your cash backs online and offline as well.

- All the Key Credit Cards have a unique feature called Temporary Lock.

- Key credit Cards have zero liability policy to control online theft and provide you protection on your purchases.

- Key Credit cards can be used everywhere where Master and Visa Cards are accepted as well as for foreign transactions.

- You will get 24 hrs personalised help line options for each and every day from Key Bank customer care team for your Key credit card.

- You will get real time notifications and automatic alerts of Key Credit Card account for balance, dues, exhaustion of credit limit etc.

- All the Key Credit cards come with no annual fees facilities.

Key Credit Card Application :

To apply for a Key Credit Card, you can refer to below mentioned instructions –

- You have to go to the official website of Key Bank with the help of the following link and by using your browser www.key.com.

- Now, go to Products menu from menu bar and click on the Credit Cards option.

- Now, click on Compare Credit Cards option from sub menu.

- In the next step, you will get four types of different Key credit card options.

- You have to choose a particular credit card option and click on Apply Now option below the description box of that credit card.

- Next, enter your area Zip Code and click on Continue button and you will be redirected to next page.

- There will be the following options for you – ‘Existing Key Bank Client?’ , ‘ New to Key Bank’ , Finish a Saved Application’.

- If you are an old member of Key Bank, you can choose the first option which will lead to towards your account Sign In process to apply for a credit card.

- New users, who are not a Key Bank’s customer, can choose the second option, and you will move to next page.

- Enter the following information – First Name, Middle Initial, Last Name, Suffix, Home Address, Social Security Number, Date of Birth, Country, Mobile Phone Number, Email Address, Complete Residential address, Financial information etc.

- Now, follow further prompts to successfully complete and submit your application form of Key Credit Cards.

Key Credit Card Account Sign Up :

After you have received your Key Credit Card, you need to set up your online account by performing the account Sign Up or enrolment process with the help of below-mentioned procedures –

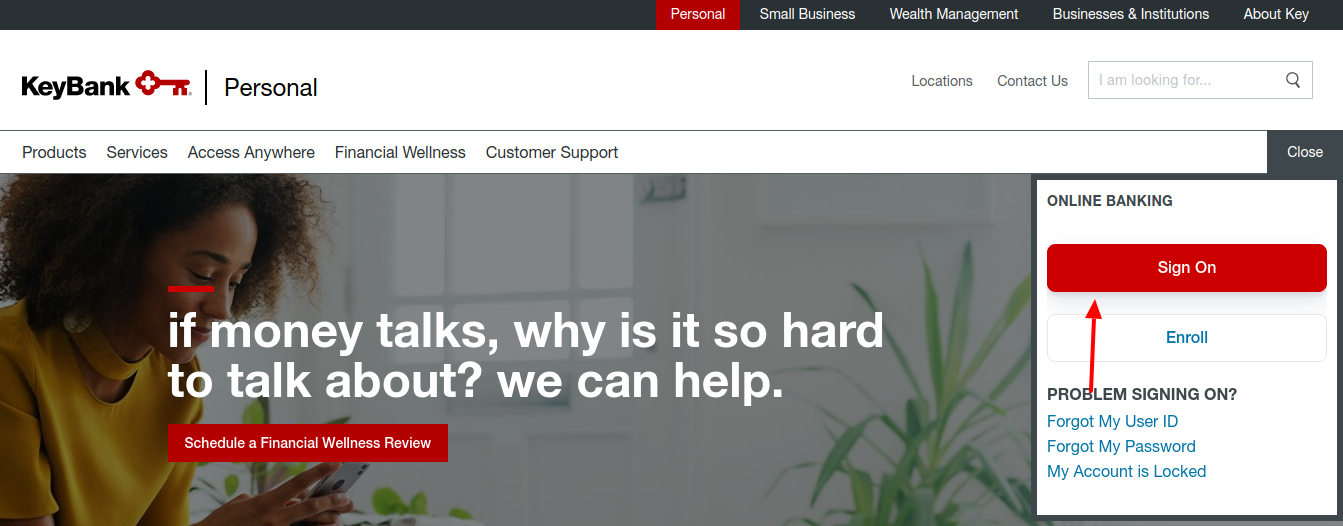

- You have to again go to the official website of Key Bank i.e. www.key.com and in the home page, at the right hand side of the page you will get Sign On widget.

- In the Sign On widget, there will be an option below the Sign On button as Enroll.

- Now, click on this Enroll button and you will go to the next step of account registration process.

- In the next step, select an option from the following – My Personal Account and My Business Account.

- In the next step, enter your Social Security Number and click on Continue button if you have selected Personal Account.

- If you have selected Business Account option, then at the next step enter your Social Security Number and Tax ID Number and after that click on Continue button.

- Follow further prompts that you will receive afterwards from Key Bank portal to complete the registration process and online account set up process of Key Credit Card.

Key Credit Card Log In :

After you have registered your Key Credit Card Online account, you can easily log in to your account by referring below mentioned step by step instructions –

- You have to again go to the official website of Key Credit Card i.e. www.key.com and at the right-hand side of the page, you will get the Sign On button.

- Now, click on Sign On button to go forward.

- In the next step, enter your User ID and click on Continue button.

- In the next step, enter your Key Credit card Account’s Password and click on Sign On button.

- After you click the Sign On button, you will be immediately logged in to log in to your respective Key Credit Card account and you can avail all the benefits of your Key Credit Card as described above and can use your card as well.

Also Read : Manage your Bj’s Credit Card Online

Key Credit Card User Id And Password Reset :

If you have forgotten the user Id or password or both of your Key Credit Card account then you can reset them easily by following below mentioned quick steps :

- At first go to the official website of the Key Credit Card by browsing the following link www.key.com and you will get the log in widget at the right hand side of the page.

- In the log in widget you will get the following links just below the Sign On button as Forgot My User ID? and Forgot My Password?’.

- You have to click on the first link i.e. Forgot My User ID? to reset your user id and you will be redirected to another page where you have to select your account type. For personal account, you need to enter your Social Security number at the next step and click on Continue button. For Business Account type, you need to enter your Social Security number and TIN number at the next step and click on Continue button. You have to follow further prompts that you will receive afterwards from Key Bank portal, and you will be able to reset the User ID of your Key Credit card account.

- You have to click on the second link i.e. Forgot My Password? to reset your Password and you will be redirected to another page where you have to select your account type. For personal account, you need to enter your User ID and Social Security number at the next step and click on Continue button. For Business Account type, you need to enter your User ID, Social Security number and TIN number at the next step and click on Continue button. You have to follow further prompts that you will receive afterwards from Key Bank portal, and you will be able to reset the Password of your Key Credit card account.

Key Credit Card Payment :

- To pay the dues of your Key Credit Card, follow the above-mentioned log in instructions to log in to your respective account and pay your Key Credit card Dues.

- You can also set auto-payment option using your Key Credit Card account and every month, your dues will be paid automatically.

- Another payment method is, you can try visiting any Key Bank branch which is nearest to you and take help from the customer help department of the bank to pay your dues.

Contact Key Credit Card :

- For more information about Key Credit Card, its facilities, and other topics, you can directly browse the following link to open the official website of Key Bank – www.key.com.

- To talk to the customer assistance department of Key Bank, you can dial the following helpline number any time, as per your convenience – 1 -800 -539 -2968 .

- For getting further specific contact options, FAQ help options, Live chatting options of Key bank, you can browse the following link – www.key.com/about/customer-service.

- You can also follow Key Bank’s activities over their different social media accounts.

Reference :