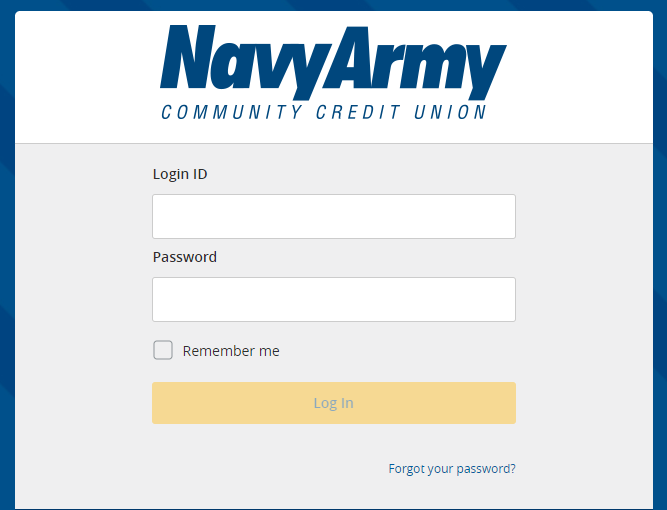

NavyArmy Community Credit Union Login:

- For the login open the page www.navyarmyccu.com

- As the page opens at the top right click on ‘Log in’ button or go to the online.navyarmyccu.com page.

- In the login, the homepage provides login ID, password. You have to hit on ‘Log in’ button.

Reset NavyArmy Community Credit Union Login Details:

- To reset the login information open the page online.navyarmyccu.com

- Once the page appears in the login screen hit on the ‘Forgot your password button.

- You have to enter your login ID click on the ‘Submit button.

Enroll for NavyArmy Community Credit Union Account:

- To enroll open the page www.navyarmyccu.com

- After the page appears in the login screen hit on the ‘Enroll personal’ button.

- You will be forwarded to the next screen to provide your last name, SSN, member number, date of birth, login ID, and hit on ‘Continue’ button.

Also Read : Login to your My Benefits Account

NavyArmy Community Credit Union Account:

NavyArmy Community Credit Union gives you the apparatuses you need to meet your monetary objectives, speedier. Furthermore, you don’t need to be in the military to join.

More than 190,000 individuals across South Texas approach high-premium bank accounts, auto and home advances, and financial records with rates 50X greater than the public normal.

Why Choose NavyArmy Community Credit Union:

- Through exceptional client care and steady enrollment, they’ve become the biggest credit association in South Texas with a staff of more than 600 workers.

- They are represented by the Texas Credit Union Department and guaranteed by the National Credit Union Administration’s National Credit Union Share Insurance Fund up to in any event $250,000.

- As a credit association, our individuals are our proprietors, separating us from other monetary organizations.

Ways to Repay Your Personal Loan Faster:

- Dispossessing Your Personal Loan: Personal advances are regularly used to satisfy momentary monetary deficiencies. In any case, an individual credit accompanies a loan fee and a reimbursement residency of 12 to 60 months. In this manner, while you had the option to meet your quick monetary prerequisites, you are loaded down with a monetary weight that expects you to repay an extra interest part on the chief sum acquired.

- Reimburse Quickly on a Higher Interest Rate: Remember that regardless of whether you meet the individual advance qualification, getting one methods pulling in a higher financing cost than home or vehicle advances. While everybody consents to the way that individual advances are a fundamental course with regards to financing, it can likewise lead you towards an obligation trap.

- Go in for Debt Consolidation Loans: You may battle to reimburse your month-to-month EMIs on schedule on the off chance that you have various obligations including individual advances. To ensure that you don’t linger behind in your own advance installments over and over again, it is ideal to select an obligation combination loan.

- Get A Home Loan Top-Up: If you have a current home advance, you can take up a home advance top-up to cover any unforeseen costs concerning home improvement rather than an individual advance. Home advances accompany more conservative financing costs in contrast with individual advances and even credit cards. Not just does it help to solidify your obligation.

- Individual Loan Balance Transfer: If you have a charge card with a huge spending limit, or are disappointed with your present bank, you can even decide to go for an individual credit balance move as a method of reimbursing it off rapidly. Under this office, your past remarkable equilibrium is totally shut.

- Pick Loan Amount: Enter the credit sum that you need, in addition to the residency of reimbursement that is appropriate that is advantageous for you. Our own credit EMI adding machine will help you to see how you can choose a residency so your month-to-month EMI sum can be effectively overseen inside your financial plan.

NavyArmy Community Credit Union Contact Information:

For further information call on 800-622-3631. Send an email to info@navyarmyccu.com. Or you can write to P.O. Box 81349. Corpus Christi, TX 78468.

Reference Link: